Why is it so important to check the special conditions when buying a property at auction?

Publish Date: 13 May 2024

By Jade Shrubsole

Further reading

Auctions have become a prominent avenue for the sale of development sites

Why is it so important to check the special conditions when buying a property at auction?

Checking special conditions when buying a property at auction is crucial for several reasons:

Legal Obligations: Special conditions outline legal obligations and terms specific to the property being auctioned. Ignoring these could lead to unintended legal consequences or financial liabilities.

Property Details: Special conditions often contain crucial information about the property, such as any existing liens, encumbrances, or restrictions on its use. Understanding these details helps buyers make informed decisions about the property's suitability for their needs.

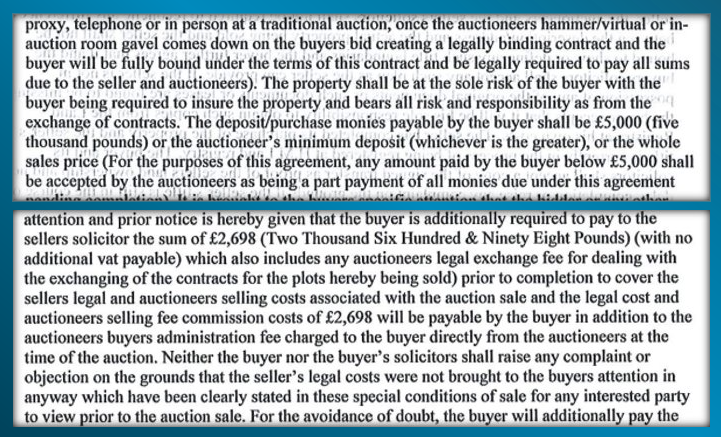

Fees: Special conditions may include details about the payment terms, deposit requirements, and any additional fees or charges associated with the purchase. Failing to review these could result in unexpected financial burdens or difficulties in completing the transaction.

Rights and Responsibilities: Special conditions outline the rights and responsibilities of both the buyer and the seller. It's essential to understand these terms to ensure a fair and smooth transaction process and to avoid potential disputes later on.

Property Condition: Special conditions may include information about the property's condition, any known defects, or required repairs. This information helps buyers assess the property's value accurately and decide whether they're willing to take on any necessary renovations or maintenance.

Contingencies: Special conditions may include contingencies that must be met for the sale to proceed, such as obtaining financing or completing inspections. Understanding these contingencies helps buyers plan accordingly and reduces the risk of the sale falling through.

Example Special Conditions:

Checking Special Conditions before buying a property at auction is essential for minimising risks, ensuring transparency, and making informed decisions throughout the purchasing process.

Other matters to check:

- Title Plan

- Lease Plan

- Date Vendor Purchased, How Much For?

- Planning Status (TPO's. Greenbelt, Conservation Area)

- Permitted Development Entitlement, How Much Left?

- Rateable Value

- Any Missing Documents?

Essential Information Group - News and Information

Keep up to date with our latest news, case studies and what's going on in the property auction industry on our blog.

Buying at auction

20/03/2025

Why the Property Auction Market is Booming Due to Stamp Duty Changes

The UK property auction market is experiencing a surge in activity in March 2025, driven primarily by impending changes to stamp duty regulations

Buying at auction

27/02/2025

Who Can Benefit from Buying a Property at a UK Property Auction?

Buying a property at a UK property auction can be advantageous for various buyers depending on their financial situation and goals. Auctions often offer unique opportunities, discounted properties, and a fast purchase process. Here’s who can benefit the most.

Buying at auction

24/02/2025

Bridging Loans Explained: A Guide for Property Auction Buyers

A bridging loan is a short-term financing solution, typically lasting up to 12 months. It provides immediate funds to bridge the gap between purchasing a property and securing long-term financing.